Educational Insights

Being Prepared Is Staying Informed

Read, Learn, Grow: Financial Insights You Can Trust

Explore our ever-expanding collection of insightful blog articles on retirement planning, tax strategies, estate organization, and more. Each post is designed to simplify complex topics, spark ideas, and help you make informed financial decisions with clarity and confidence.

Common Tax Mistakes and How to Avoid Them

Filing taxes can feel like a daunting task, especially with the ever-changing nature of tax laws and forms. Whether you prepare your own return or work with a professional, it is easy to overlook key details that can result in penalties, delayed refunds, or missed...

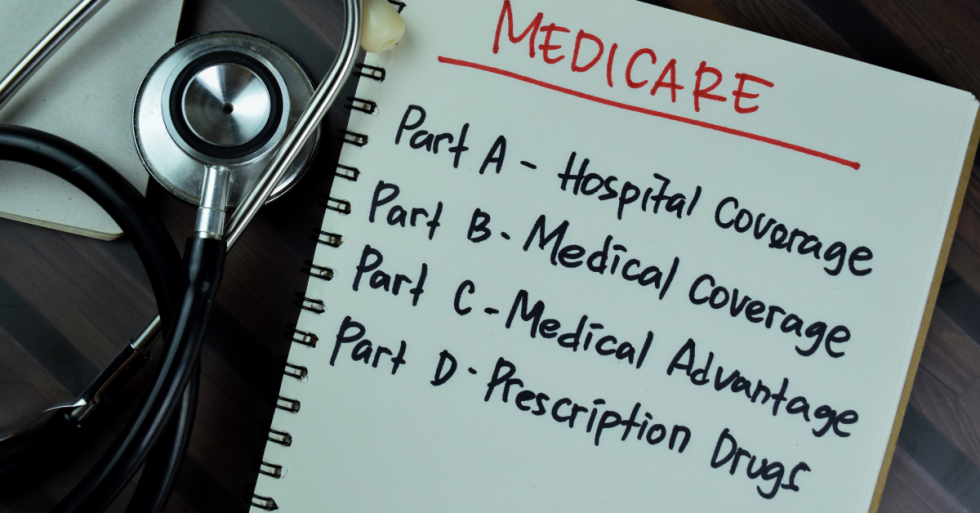

Medicare’s Impact on Your Retirement Planning

Navigating Medicare is one of the most important parts of retirement planning—yet many people approach it with uncertainty. While it offers essential health coverage beginning at age 65, Medicare is far from simple. With multiple parts to consider, coverage gaps to be...

Medicare vs Medicaid What You Need to Know

Navigating the U.S. healthcare system can be challenging, especially when it comes to understanding public programs like Medicare and Medicaid. Though these programs are often mentioned together, they serve very different purposes and populations. Knowing how they...

Top 10 Common Medicare Myths Debunked

Navigating the complexities of Medicare can be overwhelming, especially with the myriad of misconceptions that surround it. Many people approaching the age of 65 or those already enrolled in Medicare often encounter a slew of myths that can lead to confusion and...

How to Estimate Your Retirement Expenses and Plan Effectively

Planning for retirement is one of the most important financial undertakings in life. Yet, many people struggle with the question of how much they will need to cover their expenses while maintaining the lifestyle they envision. Estimating retirement expenses goes...

Financial Checkups to Start the Year on the Right Foot

A new year offers the perfect opportunity to take a fresh look at your financial health. Just as an annual physical can identify areas of concern in your overall well-being, a financial checkup helps you assess your current situation, address potential issues, and set...

End-of-Year Tax Planning Strategies

As the end of the year approaches, it’s the perfect time to take a closer look at your finances and ensure you're well-prepared for tax season. Effective year-end tax planning can help you minimize your tax liability while making the most of available deductions and...

Why Starting Early Makes a Big Difference in Retirement

When it comes to planning for retirement, time is one of your most valuable assets. While the amount you save and invest matters, when you start can have an even greater impact. Starting early gives your money more time to grow through the power of compound interest,...

Understanding Capital Gains and Losses

Understanding how capital gains and losses work is essential for anyone who invests in stocks, real estate, or other appreciating assets. When you sell an asset, the difference between your purchase price and the sale price determines whether you’ve made a gain or a...

How to Navigate Medicare Open Enrollment Period

The Medicare Open Enrollment Period is a crucial time for millions of Americans to assess and adjust their healthcare coverage. Occurring annually from October 15 to December 7, this window offers beneficiaries the opportunity to make important decisions about their...

Brought To You By: